Billing and reimbursement are crucial for the financial health of every practice, whether it’s a medical clinic or a dental office. Yet, despite appearing similar on the surface, medical billing and dental billing are two very different worlds. Understanding these differences isn’t just an administrative concern; it’s a strategic necessity for accuracy, compliance, and sustained revenue flow.

This article explores the similarities, differences, coding systems, and workflows of both billing processes, why they often get confused, and how outsourcing or specialized expertise can help practices maximize efficiency and reimbursement.

1. The Fundamentals of Medical Billing

Medical billing is the process of submitting and following up on claims with health insurance companies to receive payment for services provided by physicians and other healthcare providers. It’s a complex system that involves multiple steps—each requiring precision, compliance with regulations, and up-to-date knowledge of insurance policies.

Core Stages of Medical Billing

- Patient Registration and Verification:

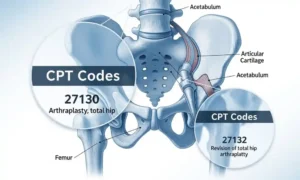

Every billing process begins with verifying patient demographics and insurance coverage. This includes gathering details such as policy numbers, payer information, and eligibility checks. - Medical Coding:

After a patient visit, medical coders translate diagnoses, treatments, and procedures into standardized codes—ICD-10 (diagnosis codes), CPT (Current Procedural Terminology), and HCPCS (Healthcare Common Procedure Coding System). - Claim Creation and Submission:

Billers use the coded information to create a claim and submit it electronically through clearinghouses to insurance payers. - Adjudication and Payment Posting:

Insurance companies review claims for accuracy, approve or deny them, and send an Explanation of Benefits (EOB). Payments are then posted to the patient’s account. - Follow-Up and Denial Management:

Any rejected or denied claims must be corrected and resubmitted to ensure payment. This stage requires expertise and persistence.

Medical billing can be overwhelming due to ever-changing payer policies, compliance regulations, and the need for meticulous documentation. However, efficient systems and trained billers ensure faster reimbursements and fewer claim denials.

2. What Is Dental Billing?

Dental billing follows a similar concept—obtaining payment from insurance companies and patients for dental procedures—but operates with its own coding systems, coverage rules, and claim formats.

While dental billing may seem simpler, it comes with its own unique challenges. Most dental practices work with limited administrative staff who juggle front desk duties, scheduling, and billing simultaneously. That’s where errors can easily creep in.

Core Components of Dental Billing

- Patient Eligibility Verification:

Dental billers confirm coverage under the patient’s dental insurance plan, including limitations such as annual maximums, waiting periods, and procedure frequency limits. - Dental Coding:

Unlike medical billing, dental coding uses the Current Dental Terminology (CDT) code set, updated annually by the American Dental Association (ADA). CDT codes categorize dental procedures—from preventive cleanings to complex restorative treatments. - Claim Submission:

Dental claims are typically sent to third-party dental insurance providers, sometimes in conjunction with medical insurers if procedures overlap (for example, oral surgery, trauma, or pathology cases). - Payment Processing and Follow-Up:

Once the claim is processed, the insurance company issues payment or an explanation of benefits. The dental biller reconciles payments and manages any discrepancies.

3. Key Similarities Between Medical and Dental Billing

While the two systems differ in execution, their underlying objectives and some operational aspects overlap.

Shared Goals and Principles

- Accuracy in Coding: Both require precise coding to ensure correct reimbursement and compliance.

- Insurance Coordination: In both cases, the biller must understand how different insurance policies cover various procedures.

- Patient Communication: Billers often act as a bridge between providers, patients, and insurers.

- Regulatory Compliance: HIPAA standards apply to both, ensuring confidentiality and data security.

- Revenue Cycle Management (RCM): Both systems contribute to the overall financial stability of a practice through timely and accurate claim handling.

5. When Dental Procedures Fall Under Medical Billing

Some dental procedures may qualify for medical billing under certain conditions—especially when they are medically necessary or involve trauma, pathology, or surgery.

Examples include:

- Oral and maxillofacial surgeries (e.g., removal of cysts, tumors, or impacted teeth)

- Biopsies and bone grafts

- Sleep apnea appliances

- TMJ (temporomandibular joint) treatments

- Dental trauma resulting from accidents or injury

In such cases, the dental provider must submit claims to medical insurance using the correct ICD-10 and CPT codes. Proper documentation is crucial to justify medical necessity.

6. Common Challenges in Both Systems

Despite their differences, both billing types face overlapping operational challenges:

a. Denials and Rejections

Errors in coding, missing documentation, or incorrect patient information can result in denied claims. Both medical and dental billers must be experts at reading EOBs and resubmitting corrected claims quickly.

b. Constant Regulatory Updates

Each year, coding systems are updated—CDT codes for dental, and ICD/CPT/HCPCS for medical. Keeping up with these changes is vital to compliance and reimbursement accuracy.

c. Insurance Company Delays

Insurers often delay payments due to incomplete or mismatched information. Strong follow-up systems and AR (accounts receivable) management are essential.

d. Staffing and Training Shortages

The post-pandemic healthcare sector continues to face staffing shortages, making it harder to retain skilled billing professionals. Outsourcing has become an increasingly attractive solution.

7. Why Specialized Knowledge Matters

A common misconception among healthcare administrators is that any billing professional can switch between medical and dental billing. In reality, each field requires specialized expertise.

Dental billers need to understand ADA guidelines, CDT code updates, and how to interpret dental benefit maximums. Medical billers must know insurance network contracts, modifier usage, and Medicare compliance.

Without proper training, a practice risks costly errors, delayed reimbursements, and potential compliance violations.

8. The Rise of Outsourced Billing Services

Given the complexities of both systems, many practices are now turning to outsourced billing partners. These specialized companies bring expertise, updated technology, and dedicated staff to manage claims efficiently.

Benefits of Outsourcing Billing

- Reduced Overhead Costs: No need for full-time billing staff or software.

- Improved Accuracy: Professional coders reduce errors.

- Faster Reimbursements: Experienced billers follow up promptly.

- Compliance Assurance: Specialists stay current with industry regulations.

- Focus on Patient Care: Providers can dedicate more time to clinical responsibilities.

9. Best Practices for Effective Billing Management

Whether you handle billing internally or outsource it, following industry best practices can significantly enhance efficiency and revenue.

- Verify Insurance Before Each Visit – Confirm patient eligibility and coverage limits to avoid surprises later.

- Stay Updated on Coding Changes – Annual updates from the ADA and AMA should be reviewed regularly.

- Standardize Documentation – Detailed clinical notes support medical necessity and speed up claim approvals.

- Use Integrated Practice Management Software – Modern platforms combine scheduling, charting, and billing into one streamlined system.

- Track Key Performance Indicators (KPIs) – Monitor metrics like first-pass claim acceptance rates, AR aging, and denial frequency.

- Train Staff Continuously – Billing rules evolve constantly; regular refresher training keeps your team sharp.

10. Future Trends in Dental and Medical Billing

As technology advances, both medical and dental billing are rapidly evolving. Here are some key trends shaping the future:

a. Automation and AI Integration

AI-powered software can detect claim errors, predict denials, and automate repetitive tasks—reducing human error and administrative workload.

b. Interoperability Between Systems

More integrated EHR (Electronic Health Record) systems now allow medical and dental practices to share patient data securely and efficiently.

c. Value-Based Reimbursement

Payers are shifting from fee-for-service to value-based care, emphasizing quality outcomes over quantity of services. Billers must adapt to new metrics and reporting standards.

d. Increased Patient Responsibility

With rising deductibles, patients are paying a larger share of healthcare costs. Transparent billing communication and flexible payment plans are becoming essential.

11. Final Comparison: Which Is Easier?

The question often asked is, “Is dental billing easier than medical billing?”

The answer depends on perspective.

- Dental billing may seem simpler due to a narrower range of procedures, but constant CDT updates and coordination with medical insurers make it complex.

- Medical billing involves broader scope and stricter regulations, requiring greater documentation and coding expertise.

12. Conclusion

Although medical and dental billing share the same ultimate goal—timely, accurate reimbursement—their paths to achieving it differ greatly. Medical billing revolves around diagnostic codes, extensive payer regulations, and multi-layered compliance standards. Dental billing, on the other hand, depends heavily on procedure-based CDT coding and preventive-focused insurance structures.

For practice owners, understanding these distinctions isn’t just academic—it directly affects profitability and patient satisfaction. Whether managed in-house or through a trusted partner, effective billing requires a blend of technology, expertise, and attention to detail.