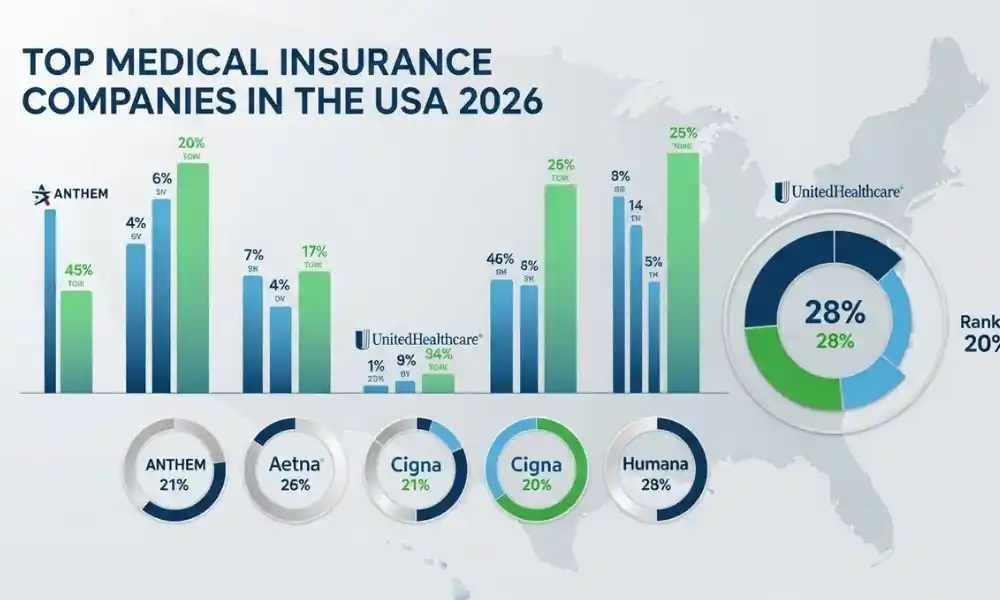

Choosing a health insurance provider in the United States can feel overwhelming. With so many options — each offering different benefits, pricing, and coverage — it’s hard to know where to start. To help you make an informed decision, here’s a closer look at some of the top medical insurance companies in the USA, what they offer, and who they’re best suited for.

Here is List of Best Medical Insurance Companies in USA

1. UnitedHealthcare

Best for: Broad network and digital tools

UnitedHealthcare consistently ranks among the largest insurers in the country. They offer comprehensive plans, a wide network of doctors, and one of the most user-friendly mobile apps in the industry. Their emphasis on digital health management makes it easy to track claims, manage prescriptions, and book appointments.

2. Kaiser Permanente

Best for: Integrated care and reliability

Kaiser Permanente is both a healthcare provider and insurer, which means you get coordinated care under one umbrella. They’re known for exceptional preventive care and customer satisfaction. However, their services are limited to certain states — ideal if you live in regions like California, Colorado, or the Mid-Atlantic.

3. Humana

Best for: Medicare Advantage plans

Humana shines when it comes to Medicare Advantage options, offering affordable premiums and strong wellness benefits. They focus on seniors and individuals seeking prescription drug coverage, fitness programs, and telehealth services.

4. CVS Health (Aetna)

Best for: Employer and family plans

Aetna, now part of CVS Health, offers a mix of affordability and accessibility. Members benefit from CVS’s pharmacy network, making prescription management easy. Their plans also include mental health resources and wellness programs, great for families and working professionals.

5. Cigna

Best for: Global coverage and customer service

Cigna is known for excellent customer support and extensive international coverage — perfect for travelers or expatriates. Their U.S. plans emphasize preventive care, mental health support, and easy access to virtual care.

6. Blue Cross Blue Shield Association

Best for: Nationwide coverage

Blue Cross Blue Shield (BCBS) isn’t one company but a network of independent insurers operating in all 50 states. This means you can find a BCBS plan almost anywhere. They offer solid nationwide networks, making them a strong choice for people who move frequently or travel often.

7. Molina Healthcare

Best for: Affordable Medicaid and Marketplace plans

Molina primarily focuses on individuals and families eligible for Medicaid or Marketplace subsidies. Their plans are cost-effective, with good preventive and primary care coverage, although networks may be more limited.

8. Centene Corporation

Best for: Low-income families and government-sponsored programs

Centene is another major player in government-backed healthcare. They manage Medicaid, Medicare, and Marketplace plans with an emphasis on community-based care. It’s a great option for those looking for affordability and support programs.

9. Highmark

Best for: Personalized care and community focus

Highmark operates mainly in the Northeast and Midwest. As part of the Blue Cross network, it combines trusted coverage with local service. Their customer-first approach and mental health support make them a solid regional choice.

10. Anthem, Inc.

Best for: Nationwide access and employer plans

Anthem (also under the Blue Cross Blue Shield brand in many states) offers strong employer-based plans and a large provider network. Their wellness programs and telehealth options are standout features for busy professionals.

11. Oscar Health

Best for: Tech-savvy users and young adults

Oscar Health brings a modern, tech-driven approach to health insurance. Their app-based system makes it easy to manage claims, talk to doctors 24/7, and track your health. Perfect for millennials and digital natives seeking simplicity and transparency.

12. Ambetter

Best for: Affordable Marketplace plans

Ambetter focuses on Affordable Care Act (ACA) Marketplace offerings, making it a go-to for individuals seeking budget-friendly coverage. Their plans often include wellness rewards and virtual care at no extra cost.

13. GuideWell (Florida Blue)

Best for: Residents of Florida

GuideWell, operating as Florida Blue, is a regional powerhouse. It provides a mix of private and government plans, excellent customer service, and community engagement programs. Ideal for Floridians wanting local care with big-brand reliability.

14. Community First Health Plans

Best for: Local, community-oriented coverage

This regional insurer is smaller but highly regarded for its personalized service and focus on community health. It’s especially beneficial for people who value localized, relationship-driven healthcare support.

15. CHRISTUS Health Plan

Best for: Faith-based and nonprofit healthcare systems

CHRISTUS Health Plan integrates care with a mission-driven approach. Their plans serve individuals and families through affordable healthcare options, especially in Texas and Louisiana.

16. Allianz

Best for: International travelers and expats

Allianz is a global leader in travel and international health insurance. If you’re relocating abroad or frequently on the move, Allianz offers comprehensive worldwide coverage and excellent claims service.

17. CareSource

Best for: Medicaid and Marketplace options

CareSource focuses on affordable care for low- to moderate-income families. Their plans provide strong preventive and chronic care management at accessible prices.

18. Scott and White Health Plan

Best for: Texans seeking regional coverage

Serving mainly Texas, this plan is known for its tight-knit provider network and affordable local care options, particularly for families and small businesses.

19. Independence Blue Cross

Best for: Pennsylvania residents

As a regional Blue Cross company, Independence Blue Cross delivers solid coverage with an emphasis on preventive care and innovative health management tools.

20. Imperial Insurance Companies

Best for: Medicare Advantage members

Imperial Insurance Companies specialize in Medicare Advantage plans, focusing on seniors who want comprehensive coverage with added perks like vision, dental, and wellness programs.

How to Choose the Right Health Insurance Company

Here are a few quick tips:

- Check network size: Ensure your preferred doctors and hospitals are covered.

- Compare costs: Review premiums, deductibles, and out-of-pocket maximums.

- Evaluate benefits: Look for mental health, prescription, dental, or vision coverage.

- Read reviews: Customer satisfaction can tell you a lot about service quality.

- Consider your lifestyle: Frequent traveler? Go with Cigna or Allianz. Need low-cost care? Try Molina or Ambetter.

Final Thoughts

The “best” insurance company depends on your personal needs, health goals, and budget. Whether you want tech-driven simplicity (Oscar Health), senior-friendly coverage (Humana), or global protection (Cigna, Allianz), there’s an option for everyone. Taking the time to compare these top providers will help you find a plan that keeps both your health — and wallet — in great shape.